A major a part of Tesla’s development in gross revenue final quarter got here from a rise in earnings from servicing Tesla’s automobiles and promoting vitality by means of its Supercharger community – issues Elon Musk mentioned Tesla wouldn’t purpose to make earnings from.

Again in 2016, Elon Musk was quoted saying this at a Tesla occasion when defending the automaker’s technique to function its personal service facilities quite than utilizing dealerships:

Our philosophy with respect to service is to not make a revenue from service. I believe that it’s horrible to make a revenue on service.

Musk typically criticized different automakers, particularly GM, for promoting “automobiles that then want service” at dealerships after which making loads of earnings promoting alternative elements to prospects by means of these dealerships.

The CEO is usually quoted saying, “The perfect service is not any service,” and Tesla goals to enhance service by rising the reliability of its automobiles, leading to much less want for service.

Actuality is sort of totally different. Tesla homeowners are sometimes experiencing lengthy wait occasions to get service appointments at Tesla and the way the automaker plans to handle this example was a high query throughout Tesla’s earnings name yesterday.

As for the Supercharger community, Musk additionally mentioned that it will “by no means change into a revenue heart” for Tesla.

The CEO all the time mentioned that the purpose was of the charging community was to be a service for Tesla homeowners, and now non-Tesla homeowners, with the purpose of revinesting income into rising the capability of the community.

Tesla’s actuality is altering

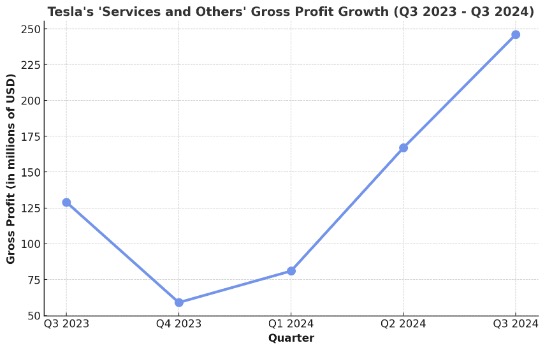

During the last two quarters, Tesla’s earnings from “companies and others” have surged.

For the previous few years, Tesla’s companies and others had been solely marginally worthwhile, which was in step with Musk’s beforehand said technique on that entrance, however one thing has modified.

With Tesla’s Q3 2024 monetary outcomes, the automaker that “companies and others” gross earnings jumped to nearly $250 million – a 90% enhance year-over-year:

Tesla is without doubt one of the most opaque automakers in the case of breaking down its financials. It bundles many issues into “companies and others, ” making it onerous to know precisely what’s going on inside.

The majority of that accounting line has traditionally been automotive service and used automotive gross sales, however in Tesla’s newest monetary outcomes, which noticed an vital enhance in earnings for “companies and others”, the automaker confirmed that the surge was particularly as a result of its Supercharger community and repair margins:

The Providers and Different enterprise achieved a report gross revenue in Q3, rising over 90% year-on-year. Sequential development in gross revenue was pushed principally by larger gross revenue era from supercharging, service heart margin enchancment and better gross revenue era from Elements Gross sales and Merchandise.

Now at $~250 million, it’s nonetheless a small a part of Tesla’s general gross earnings, but it surely does account for a big a part of the ~$800 million enhance in gross earnings in comparison with final yr.

Electrek’s Take

That is one thing that irritates me personally as a result of I’ve used these quotes from Elon about service to counter the hesitation of many potential Tesla consumers relating to the upkeep and repair of electrical automobiles.

Elon’s assertion reassured them, but when that was ever actually the plan, it actually isn’t anymore based mostly on the newest outcomes.

Tesla’s gross margins for service and promoting alternative elements are surging, and Tesla is proudly saying it in its monetary outcomes.

Myself, I’ve two Tesla automobiles that want service proper now and Tesla is making an attempt to promote me very costly elements.

As for Supercharger, costs are going up.

To be truthful, Tesla making a living on the Supercharger community is sort of new and the corporate is simply beginning to promote extra charging to non-Tesla EVs. It’s very attainable that Tesla may want to regulate to maintain the Supercharger simply marginally worthwhile.

It’s simply the truth that Tesla writes “sequential development in gross revenue was pushed principally by larger gross revenue era from supercharging,” it’s not tremendous encouraging.

However within the meantime, some Supercharger stations are getting fairly costly. Hopefully, Tesla will get these costs into management

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.