Tesla (TSLA) will launch its This fall 2024 and full-year 2024 monetary outcomes on Wednesday, Jan. 29, after the markets shut. As normal, a convention name and Q&A with Tesla’s administration are scheduled after the outcomes.

Right here, we’ll take a look at what the road and retail buyers count on for the quarterly outcomes.

Tesla This fall 2024 deliveries

Whereas Elon Musk and his loyal shareholders wish to say that Tesla is now an AI/Robotics firm, the corporate’s automotive enterprise nonetheless drives its financials.

Earlier this month, Tesla disclosed its This fall 2024 car manufacturing and deliveries:

| Class | Manufacturing (items) | Deliveries (items) | Working Lease Accounting (%) |

| Mannequin 3/Y | 436,718 | 471,930 | 5 |

| Different Fashions | 22,727 | 23,640 | 6 |

| Complete | 459,445 | 495,570 | 5 |

This quarter, deliveries got here considerably deliveries under Wall Road’s expectations.

Now that vitality storage is beginning to contribute to Tesla’s income extra meaningfully, the corporate has additionally began sharing deployment in its quarterly supply and manufacturing numbers.

This quarter, Tesla confirmed that it deployed 11 GWh of vitality storage by means of its Megapack and Powerall merchandise – a brand new file.

Tesla This fall 2024 income

For income, analysts typically have a reasonably good concept of what to anticipate, because of the supply numbers, and now the vitality storage deployment knowledge.

Nevertheless, issues have been more and more troublesome as Tesla’s common value per car is altering ceaselessly nowadays because of frequent value cuts and reductions throughout many markets.

Analysts needed to readjust over the previous few weeks after Tesla’s deliveries got here below their expectations. Now, additionally they must account for vitality storage, which achieved a brand new file. Vitality storage revenues ought to obtain a brand new file, however possibly not as excessive as some imagine as a result of Tesla has lower Megapack costs during the last 12 months.

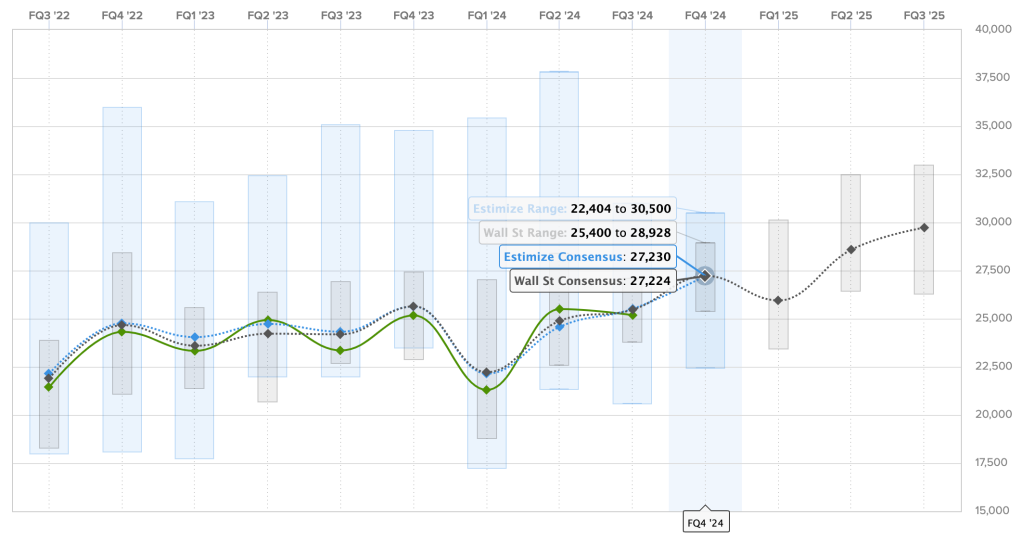

The Wall Road consensus for this quarter is $27.224 billion, and Estimize, the monetary estimate crowdsourcing web site, predicts a slighty increased income of $27.230 billion.

Listed below are the predictions for Tesla’s income over the previous two years, with Estimize predictions in blue, Wall Road consensus in grey, and precise outcomes are in inexperienced:

Final quarter, Tesla missed on income, however they’re anticipated to be increased this quarter whereas the expectations are cheap.

Tesla This fall 2024 earnings

Tesla at all times makes an attempt to be marginally worthwhile each quarter because it invests most of its cash into development, and it has been profitable in doing so during the last three years.

Like revenues, it has been tougher to estimate earnings over the previous few years, with value cuts and backed loans decreasing Tesla’s industry-leading gross margins.

This fall can also be usually completely different as a result of Tesla typically accumulates and promote extra ZEV credit, which may considerably increase its earnings.

For This fall 2024, the Wall Road consensus is a achieve of $0.77 per share and Estimize’s crowdsourced prediction is a bit of increased at $0.79.

Listed below are the earnings per share during the last two years, the place Estimize predictions are in blue, Wall Road consensus is in grey, and precise outcomes are in inexperienced:

Final quarter, Tesla had a major beat in EPS in comparison with expectations because of decrease prices, which was shocking as a result of the corporate had guided increased prices just some months prior.

Different expectations for the TSLA shareholder’s letter and analyst name

Yesterday, I shared a listing of all probably the most upvoted shareholder questions which might be prone to be requested in the course of the convention name following the earnings outcomes.

Unsurprisingly, they need to know concerning the newest unsupervised self-driving timelines and Optimus, which Musk has framed because the applications that may flip Tesla into “the world’s most beneficial firm.”

I might hope that some shareholders and Wall Road analysts would ask how Musk’s first rate into insanity is affecting the corporate, however I don’t need to get my hopes up.

In actuality, the primary factor that would drive Tesla’s share value up from feedback or statements made in the course of the earnings are associated to the brand new cheaper fashions based mostly on Mannequin 3/Y that Tesla is meant to launch within the coming months.

They’re the one factor proper now that may flip Tesla’s automotive enterprise again to development.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.